Indicators on Pacific Prime You Should Know

Your agent is an insurance policy professional with the knowledge to direct you with the insurance procedure and aid you discover the very best insurance coverage security for you and individuals and things you care regarding many. This write-up is for informational and pointer purposes only. If the plan protection summaries in this article conflict with the language in the policy, the language in the policy applies.

Insurance policy holder's fatalities can likewise be contingencies, particularly when they are taken into consideration to be a wrongful fatality, as well as building damages and/or damage. Because of the uncertainty of said losses, they are identified as backups. The insured individual or life pays a costs in order to obtain the benefits promised by the insurance provider.

Your home insurance coverage can aid you cover the damages to your home and pay for the price of rebuilding or fixings. Sometimes, you can also have protection for items or prized possessions in your residence, which you can then purchase replacements for with the cash the insurance policy company provides you. In case of an unfortunate or wrongful death of a sole income earner, a family members's financial loss can possibly be covered by specific insurance strategies.

Some Known Factual Statements About Pacific Prime

There are various insurance coverage intends that consist of financial savings and/or financial investment plans in enhancement to routine insurance coverage. These can help with building savings and wide range for future generations via normal or reoccuring financial investments. Insurance coverage can aid your family members keep their criterion of living in case you are not there in the future.

The most basic form for this type of insurance coverage, life insurance policy, is term insurance coverage. Life insurance coverage in basic aids your family end up being protected monetarily with a payout amount that is offered in the event of your, or the plan holder's, fatality during a particular plan period. Child Plans This kind of insurance is primarily a savings instrument that aids with creating funds when kids get to certain ages for going after college.

Home Insurance coverage This kind of insurance coverage covers home damages in the incidents of mishaps, natural catastrophes, and incidents, in addition to other comparable occasions. international travel insurance. If you are seeking to seek payment for mishaps that have taken place and you are battling to determine the correct path for you, get to out to us at Duffy & Duffy Regulation Firm

The Single Strategy To Use For Pacific Prime

At our law practice, we comprehend that you are going through a lot, and we comprehend that if you are involving us that you have actually been through a lot. https://freddys-marvelous-site-a71e82.webflow.io/. Due to that, we supply you a complimentary examination to review your concerns and see just how we can best aid you

Since of the Check Out Your URL COVID pandemic, court systems have actually been closed, which negatively influences vehicle accident cases in a tremendous way. Once again, we are below to aid you! We proudly serve the individuals of Suffolk Region and Nassau Region.

An insurance plan is a lawful agreement in between the insurance provider (the insurance firm) and the person(s), company, or entity being guaranteed (the insured). Reviewing your policy helps you validate that the policy meets your needs and that you recognize your and the insurer's responsibilities if a loss occurs. Numerous insureds buy a plan without understanding what is covered, the exclusions that remove coverage, and the conditions that must be met in order for insurance coverage to apply when a loss occurs.

It determines that is the insured, what threats or property are covered, the plan limits, and the plan period (i.e. time the policy is in force). The Declarations Web page of a life insurance policy will include the name of the person insured and the face amount of the life insurance policy (e.g.

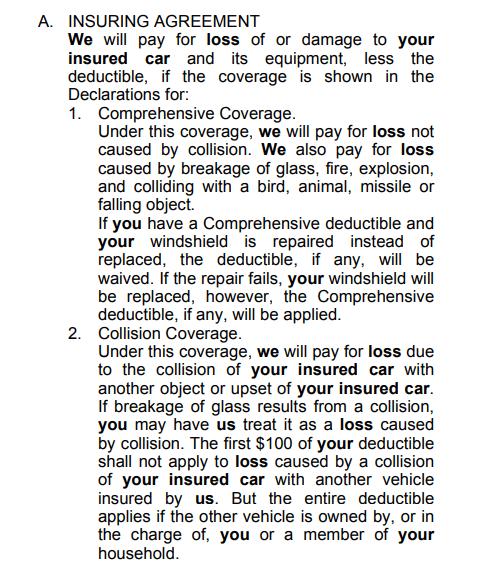

This is a summary of the major guarantees of the insurance policy business and states what is covered.

Examine This Report on Pacific Prime

Allrisk insurance coverage, under which all losses are covered except those losses especially omitted. If the loss is not omitted, then it is covered. Life insurance coverage plans are typically all-risk plans. Exclusions take protection far from the Insuring Arrangement. The three major kinds of Exclusions are: Omitted risks or sources of lossExcluded lossesExcluded propertyTypical instances of omitted dangers under a homeowners plan are.